Surrey Property Market Headlines

It’s been an extraordinarily busy time if you’re selling or letting a property in Surrey:

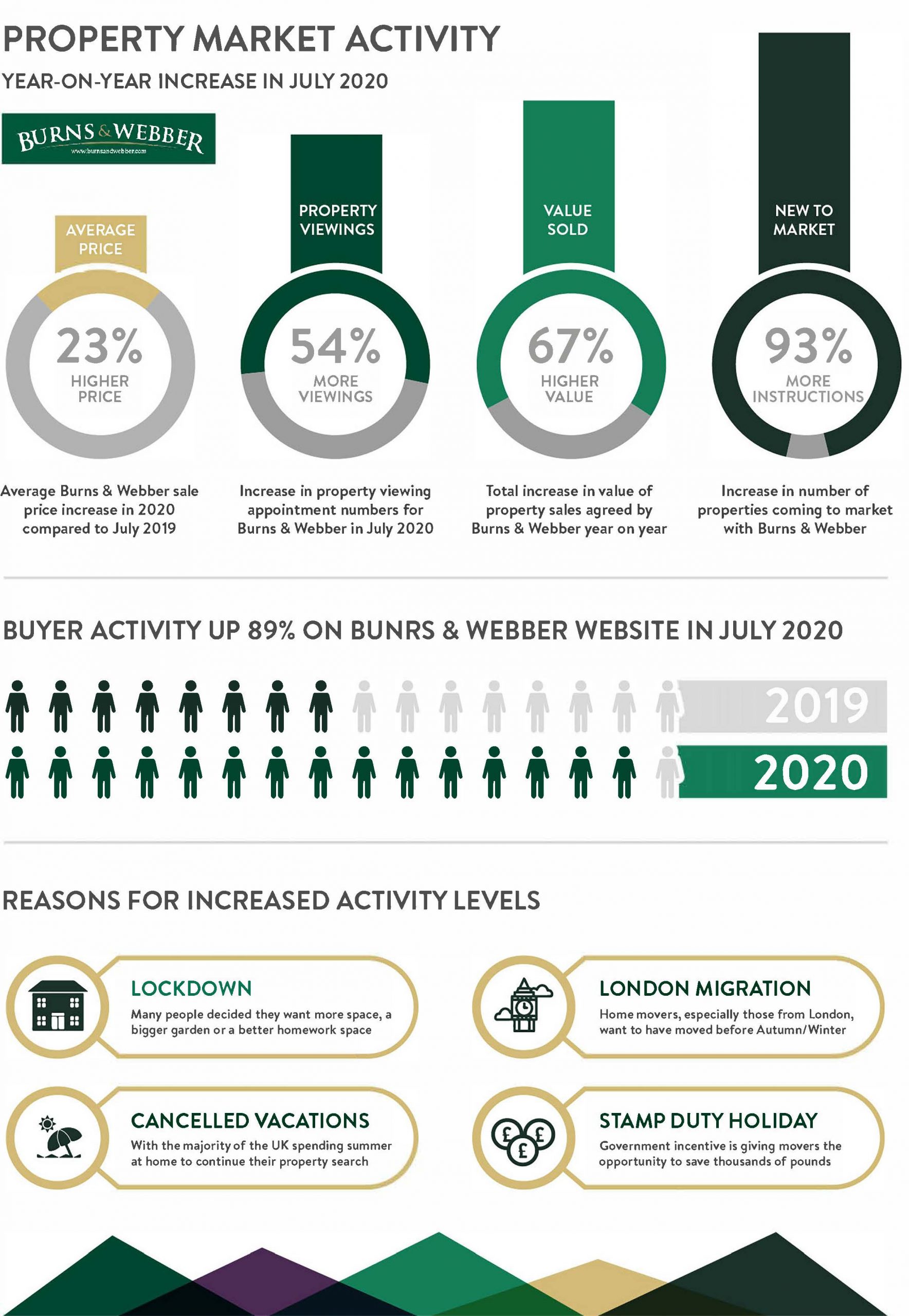

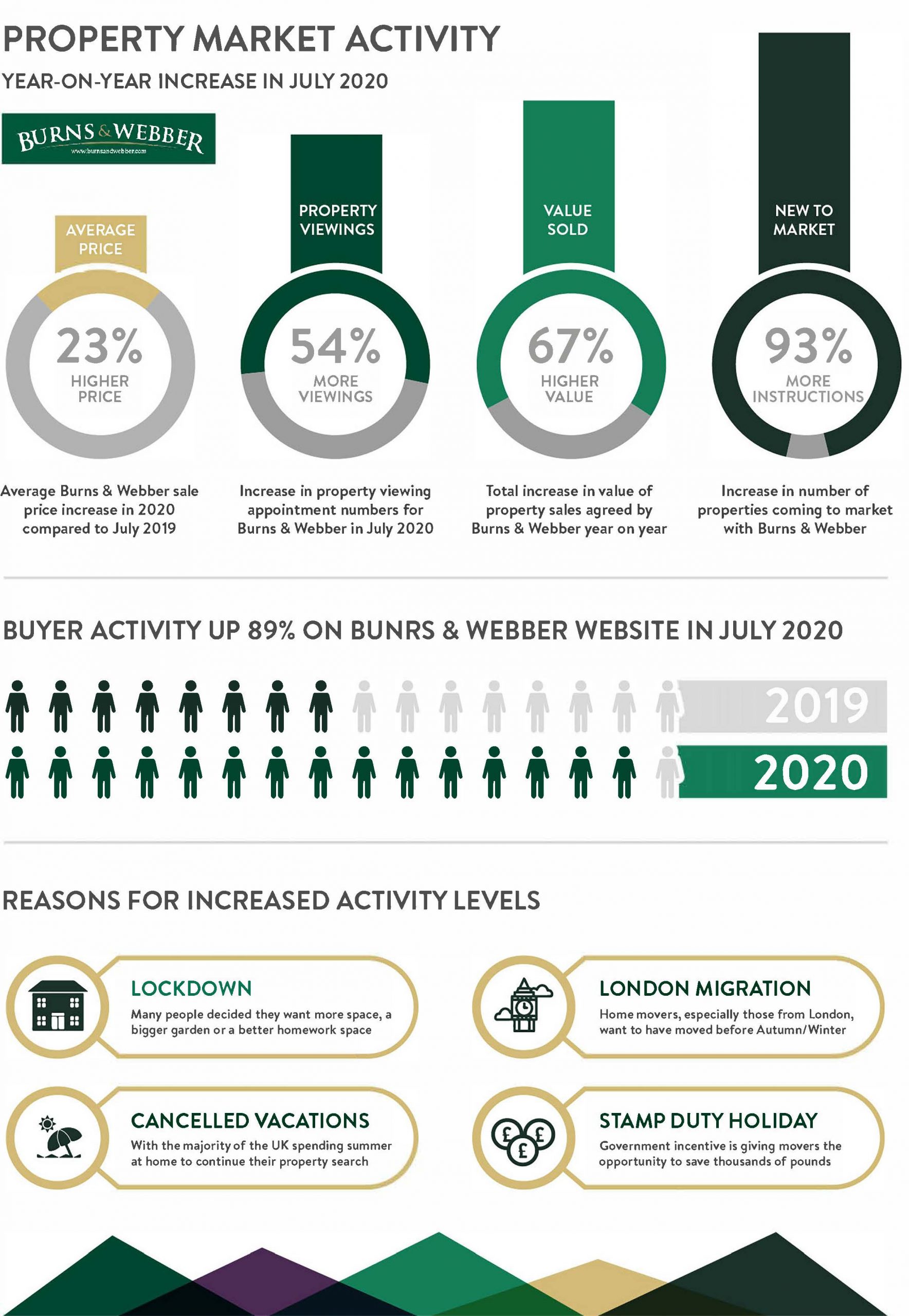

- Total value property sales agreed by Burns & Webber rose by 67% year on year in July

- Average sale price agreed by Burns & Webber in July up by 23% compared to July 2019

- 93% increase in properties coming to the market with Burns & Webber in July compared to last year

- 54% increase in Burns & Webber property viewings in July 2020 year on year

- 89% increase in buyer activity on Burns & Webber website in July compared to 2019

- Rightmove reported buyer enquiries up 75% year on year in Britain since the start of July and enquiries from Londoners about village properties rose by 144%

- Burns & Webber tenant viewings doubled year-on-year in July due to upsurge in rental demand outside of London

- Many properties were either let in the first 48 hours or sold in the first week of coming to market

What’s the reason for the dramatic increase in activity levels?

In our experience, here are the four key factors driving our extraordinarily high volume of property sales and helping to achieve exceptional prices for our clients.

Change In Property Requirements

An unforeseen, but positive effect of lockdown was that it highlighted to many of us how much we value spending time with our families and also made us question whether our current living accommodation is suitable for the lifestyle we desire.

Buyers are commonly now looking for more space, a bigger garden or a better homework space than they currently have, prompting them to come to the market in search of a more suitable property for their needs, this includes a shift to homeworking which has put space for a home office high on many buyers requirement list.

Cancellation Of Summer Vacations

A typical year will see interest in property ebb and flow throughout the year, with more transactions happening in Spring/Autumn and a lull in the Summer months as families go away on foreign holidays.

The reluctance to use air travel and possible quarantine periods upon return is dissuading many people from taking foreign holidays – the result is previously unseen large numbers of buyers, sellers and tenants that are still in the market to move throughout Summer, providing a sustained and dramatically increased activity levels compared to what we would normally see at this time of year.

People Want To Move Before Another Possible Lockdown

Fears of a second wave of the Coronavirus pandemic and the Government asking us to spend another stint confined to our homes has motivated people to get their move completed before the Autumn and Winter arrive. This is especially true when we look at the number of buyers migrating from London to settle in the home counties, as many do not want a re-run of their inner city lockdown experience that they endured in March 2020.

Rightmove.co.uk report that most of the top village destinations that people in cities are moving to are still within a commutable distance to their city but with the appeal of a quieter way of life; this puts Surrey at the top of the list for many Londoners.

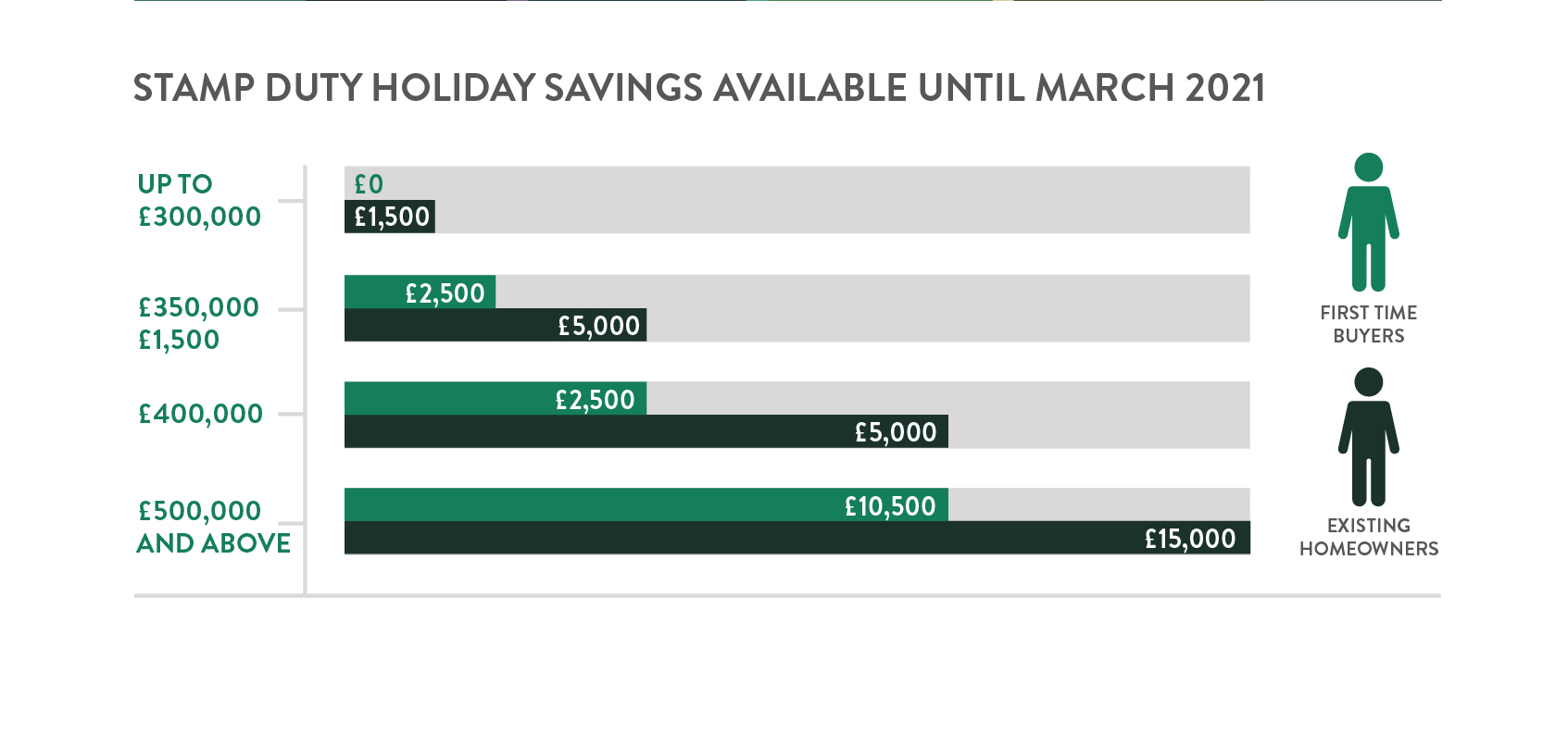

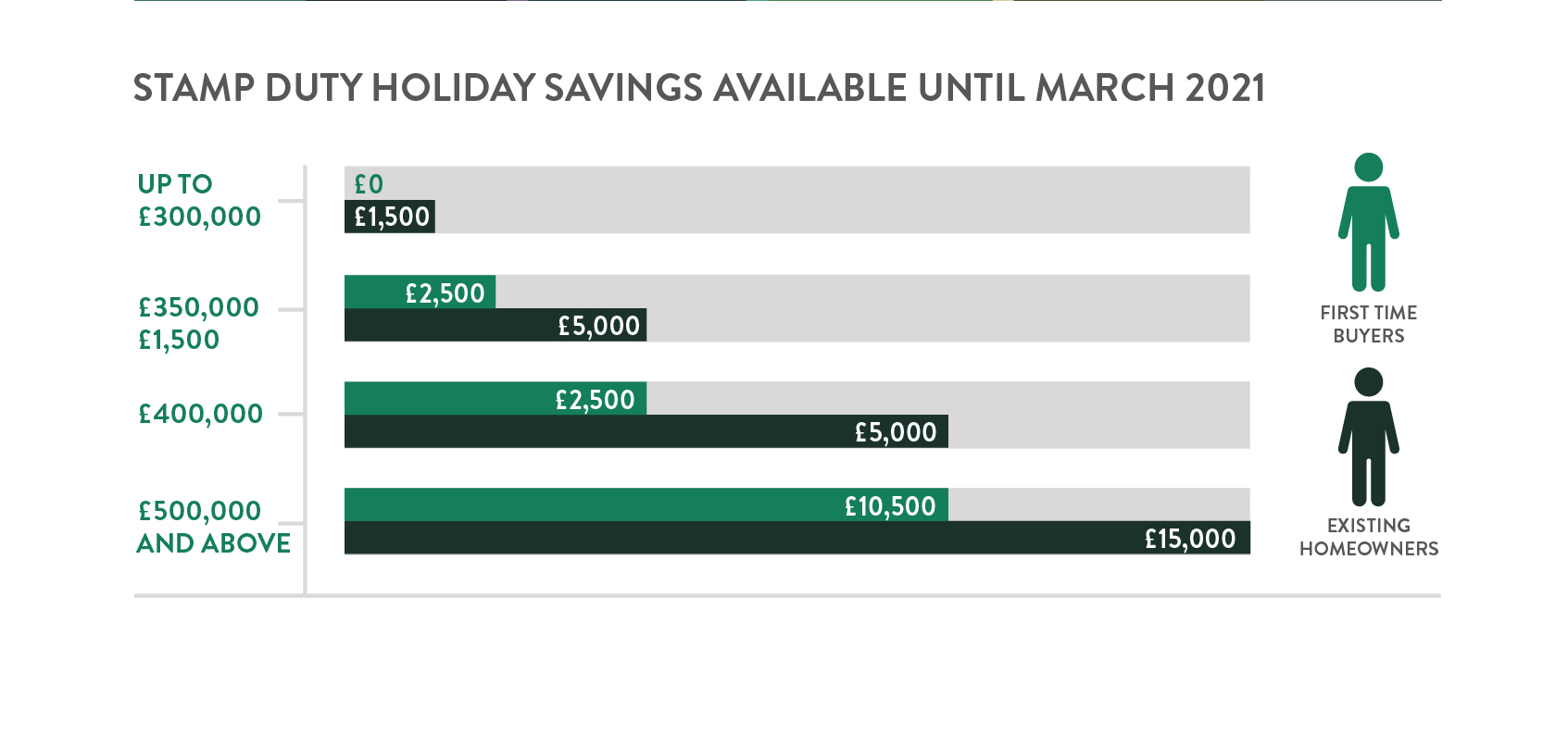

Stamp Duty Holiday

The housing market continues to be an essential component of the UK economy and the announcement of a Stamp Duty Holiday by the Chancellor, Rishi Sunak, created a further boost to the housing market, lowering the price of entry to purchase your first home and giving existing homeowners the opportunity to save thousands of pounds on Stamp Duty Land Tax (SDLT); money that can now be spent on the home when moved into and supporting an entire industry of businesses built around people moving and improving their homes.

The Stamp Duty savings are not only for properties under £500,000 as in reality buying any home over £500,000 will save you £15,000 in stamp duty.

We anticipate these elevated levels of buyer activity to last until at least March 2021 when the Stamp Duty Holiday is currently scheduled to come to an end.

Challenges Currently Facing Buyers & Sellers

Mortgage Applications

In July Curchods Mortgage Services arranged the largest number of mortgages since February 2018 as the purchase market continues to thrive.

The sheer volume of transactions, combined with furloughed staff shortages means that lenders are stretched to full capacity and the challenges faced on the financial side of the transaction will have implications for buyers and sellers. Current advice to mortgage brokers is not to call lenders to chase applications while they deal with the current backlog – a clear sign of the strain the system is under.

We are currently having to manage our client’s expectations with regards to realistic time frames for survey dates and mortgage offers, as some lenders are taking 14-18 days simply to look at a case.

If you are buying or selling with Burns & Webber, our advice is to entrust the buyer’s mortgage application to our in-house mortgage brokers so we can closely monitor the financial side on your behalf to speed up the process as much as possible.

It is also worth noting that some lenders have tightened their loan criteria and underwriting due to additional Covid-19 based concerns, so if you are thinking of buying it’s important to speak to a mortgage broker as soon as possible to understand where you sit financially and what is your buying position.

First Time Buyers

Zoopla recently reported that the number of loans available for some buyers has fallen in recent months. However, with the number of mortgages available for first time buyers around half the levels seen pre Covid-19, according to data from Moneyfacts – there are now some 1,360 deals for first time buyers compared to 2,670 before lockdown.

However, some of the rates on offer for these mortgages are competitive, with two year fixes on offer from 2.24% for those with a 10% deposit. For five year deals, rates are available from 2.56%.

Property Sellers

The demand for homes is currently outstripping the number of homes being listed for sale with properties now regularly receiving multiple offers within the first week of marketing with many achieving above their asking price.

The challenge now is to ensure that all the sales which have recently been agreed in large numbers now proceed to completion.

The UK economy suffered its biggest slump on record between April and June during the Coronavirus lockdown. With the potential for a deepening recession around the corner, we are working closely with our Conveyancing Solicitors to ensure all the searches are completed promptly and that we carefully manage each transaction to ensure as many as possible reach completion successfully and mitigate any effects the recession may have on buyer’s finances. We are encouraging all our buyers and sellers to use our in-house conveyancing team as they stand a better chance of reaching completion if they do so.

90% of our sales complete successfully vs an industry average of just 66%, thanks to our fast and efficient conveyancing service

If you have been considering a move and have a property to sell, the only way to be taken seriously as a buyer and have an offer considered is if your property is either on the market or you have a sale agreed on your existing home.

If you haven’t done so already, you can start to get the wheels in motion by booking an up-to-date marketing appraisal of your home – we can help you understand the achievable sale price and the current buyer demand for your specific property. Book a free valuation of your home, this service is free and without obligation.

BOOK FREE VALUATION