Stamp Duty Holiday Extended

Stamp Duty Holiday will be extended from March 31 to June 30; “and then, to smooth the transition back to normal, the nil rate threshold will be £250,000 until the end of September.”

Making the announcement this afternoon, Sunak said:

“The cut in stamp duty I announced last summer has helped hundreds of thousands of people buy a home and supported the economy at a critical time. But due to the sheer volume of transactions we’re seeing, many new purchases won’t complete in time for the end of March.”

This means there will continue to be a Stamp Duty Holiday until the end of June for properties up to £500,00. When the threshold reduces to £250,000 until the end of September, this represents a £2500 cash saving for anyone purchasing a property over £250,000. From 1st October pre-Covid stamp duty thresholds and levels will return.

Andrew Dewar, Joint Senior Partner, comments:

“This is very welcome news for tens of thousands of people part way though their transactions. The Government clearly recognised the damage that would have ensued had the scheme ended on the 31st March as originally suggested.”

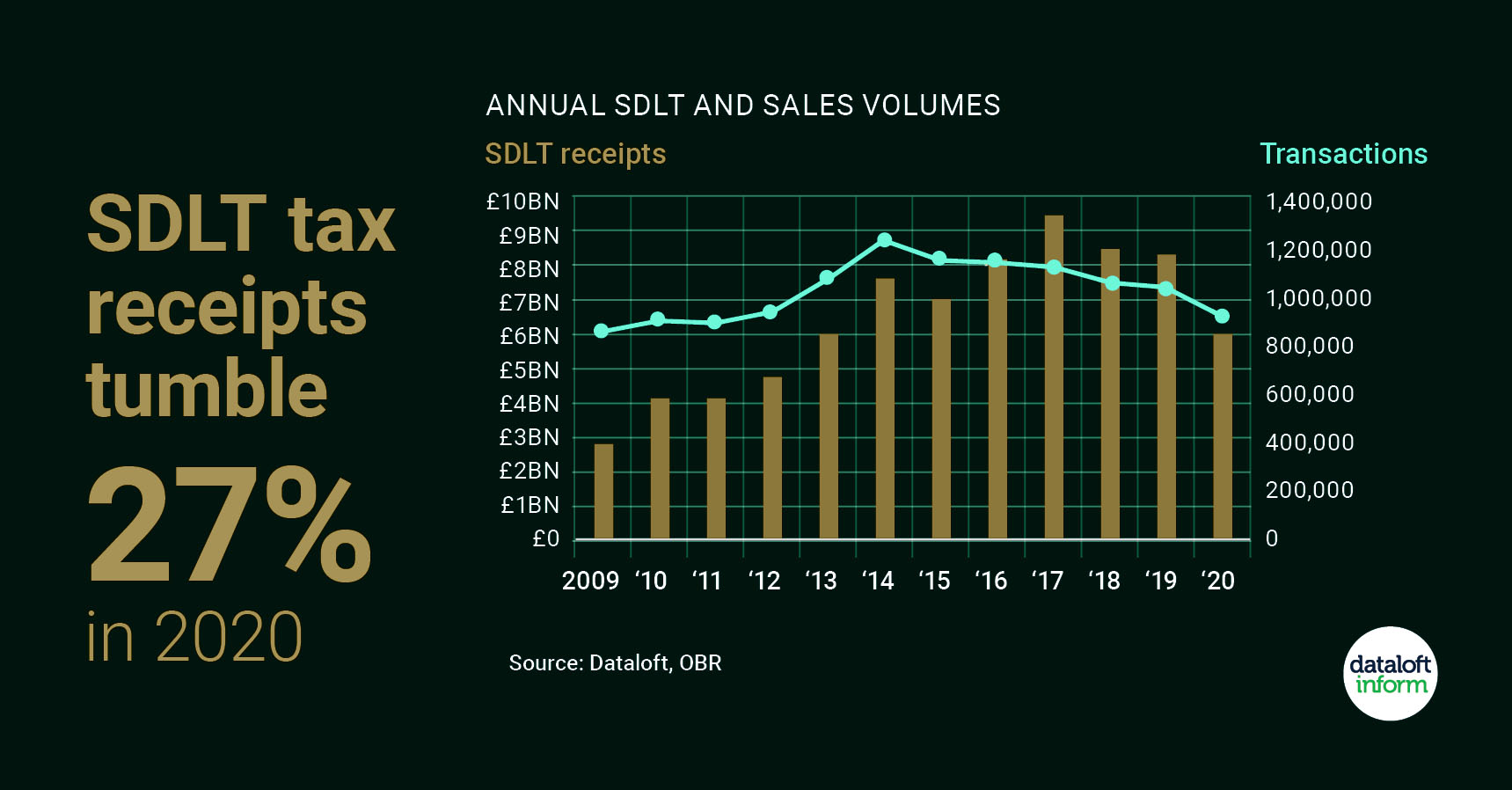

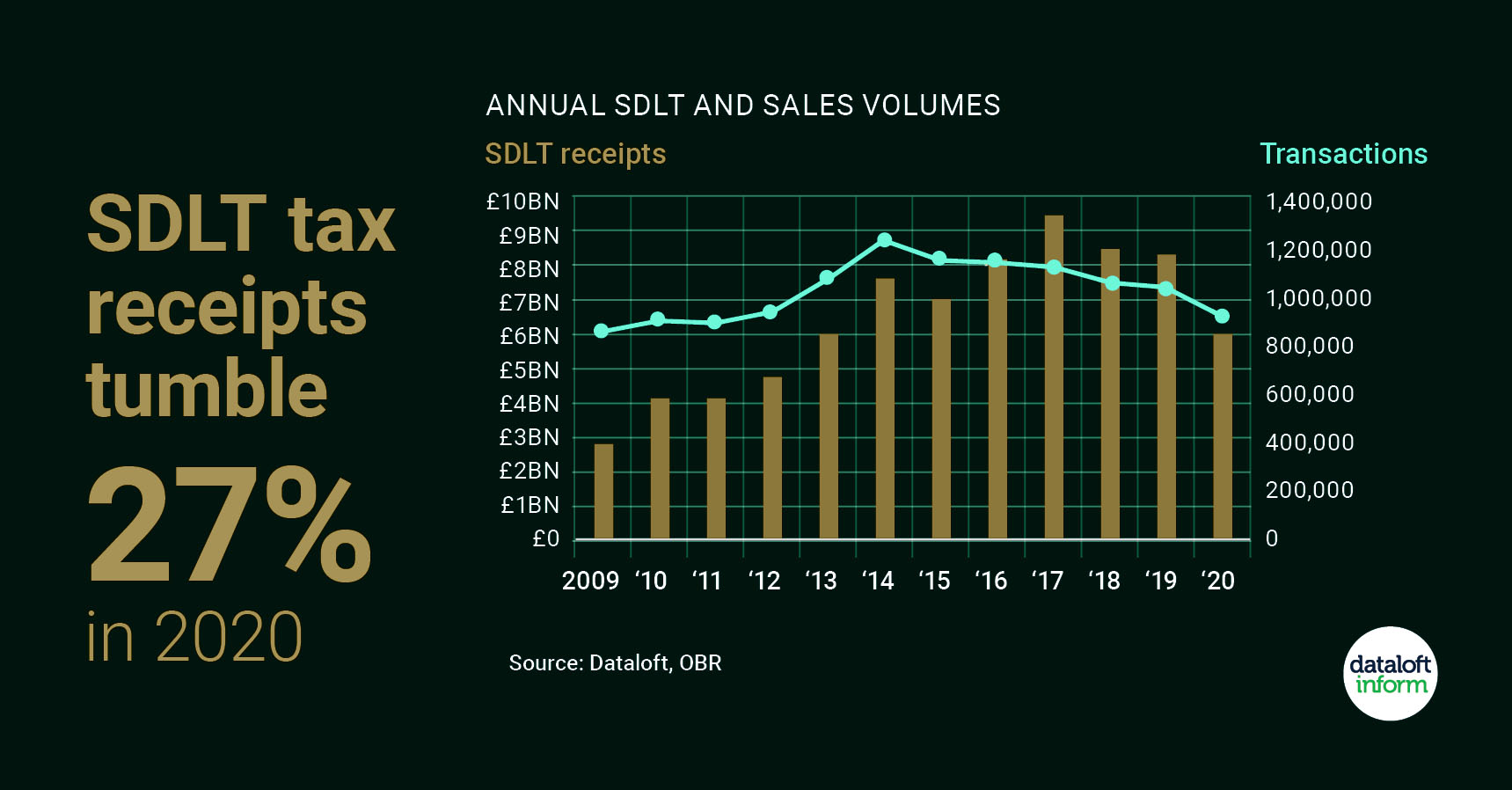

Just over £6 billion was collected by the Treasury in England in SDLT property tax in 2020.

This is £2.2 billon less than in 2019, a 27% fall. But, the Stamp Duty Holiday has resulted in a much busier housing market over the last 12 months than we may have expected, with over 300,000 property transactions were ineligible for tax in the final 6 months of the year, the majority a result of the Stamp Duty Holiday.

This increase in transactions has put additional pressure on the professionals involved in these transactions; estate agents, solicitors and mortgage lenders now need dig deep and work in harmony to ensure any roadblocks or delays caused by the volume of transactions are now eradicated to be sure the generous reprieve the Government has offered is rewarded with success.

Stamp Duty Calculator

Government Guarantee Enables Return Of 95% LTV Mortgages

A mortgage guarantee scheme to help people with small deposits get on the property ladder was announced by Rishi Sunak in the Spring Budget.

Chris Pain, Director of Curchods Mortgage Services, comments:

“The Government will offer guarantees to lenders, bringing back 95% mortgages which will mean more lenders will be comfortable in offering high loan to value mortgages. This will increase the supply and competition between lenders which will subsequently drive down interest rates and therefore the costs for consumers.”

This announcement is fantastic news for many people who are currently renting with desires to get on the housing ladder as they make mortgage borrowing more accessible and more affordable to anyone who can’t afford a large deposit.

The government-guaranteed 95% Loan To Value (LTV) Mortgages will be available from next month April 2021, on the purchase of properties up to the value of £600,000.